Rehashing the Basics

February 11, 2021

What is Microfinance?

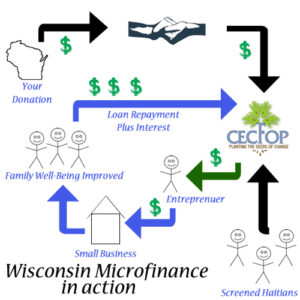

Making small loans to individuals that lack collateral and that are not able to take out a loan from a bank, credit union or other traditional financial institution is the purpose of microfinance. Access to banking systems and capital in the developing world is extremely limited and hinders the ability of individuals and communities to rise out of poverty. Microfinance creates an opportunity for individuals to get access to capital to invest in their businesses and dreams.

Who gets the loans?

Organizations that work in microfinance have relationships with on-the-ground partners that ensure the goal of microfinance is met. Those who receive loans are vetted and their business proposal is reviewed. Wisconsin Microfinance does not participate in the vetting or review as our ideas of what a good business might be would have little relationship to what might be a successful business in the developing world. Repayment of microloans is incredibly high, and the small size of each loan allows for a lot of people to be helped.

Does microfinance work?

The question “why and how do countries develop?” has been documented and studied, yet debate around development and prosperity continues to rage on. Many of the more immediate problems facing the developing world are often addressed through aid. Aid is another way of saying that someone else is providing food, water, medicine or shelter for those in the developing world. One of the main criticisms of aid is that it often creates dependency issues and disincentivizes people from seeking control over their own livelihoods. Microfinance, on the other hand, is the opposite of aid. By providing access to capital people are empowered to be responsible for their own success. The ability to access capital is fundamental to starting or growing a business and becoming responsible for a family’s economic success. Microfinance has also made huge advancements in advancing the economic power of women in developing countries by giving them fair and equal access to microcredit. Microfinance does work and while it’s still in its early ages as a tool for development it has seen incredible results.

Where does Wisconsin Microfinance come in?

Wisconsin Microfinance was started in 2010 when UW-Madison Professor Tom Eggert and some students decided to use microfinance to help families in Haiti following a major earthquake. Wisconsin Microfinance worked through a local partner to provide money for small loans to individuals in Haiti. Soon after, Wisconsin Microfinance added a new program in the Philippines, after a deadly typhoon hit in 2013. Wisconsin Microfinance’s mission is not only to raise money and fund loans but to educate our community about the success of microfinance and its ability to spur entrepreneurship and alleviate poverty.

What results has Wisconsin Microfinance seen?

The work of Wisconsin Microfinance has resulted in hundreds of families in Haiti and the Philippines lifting themselves out of poverty. The money provided to Haiti and the Philippines funds loans which are paid back, and this paid back money is thus used for additional loans. Since the beginning of Wisconsin Microfinance over $300,000 of loans have been made and repayment rates are around 85 percent. 66 percent of Wisconsin Microfinance’s loan recipients in Haiti are female and in the Philippines it is 93 percent. The real-life impacts of these loans included better housing, access to healthcare, access to educational opportunities for children, and many more. One donation improves the lives of many individuals, and Wisconsin Microfinance will continue to expand its programming and educate individuals in Wisconsin about the power of microfinance.